FADA Sales Report May 2024: CV Segment Experienced A 4% YOY Growth

By Priya Singh

4001 Views

Updated On: 10-Jun-2024 02:11 PM

According to the latest FADA Sales Report, combined CV sales reached 83,059 units in May 2024 compared to 79,807 units sold in May 2023.

Key Highlights:

- FADA reports 4% YoY growth in May 2024 CV sales, reaching 83,059 units.

- Sales were affected by elections and weather, but boosted by bus orders and sector activity.

- Tata Motors leads OEM sales with 35.38% market share, followed by Mahindra & Ashok Leyland.

- LCV segment grew by 7.94% YoY, while HCV sales declined by 3.23%.

- MoM CV sales declined by 8.43%, with 90,707 units sold in April 2024.

FADA, the Federation of Automobile Dealers Association has shared the commercial vehicle sales data for May 2024. The CV segment experienced a growth of 4% YoY.

Dealers indicated that sales were significantly affected by elections and extreme weather conditions. Although there was growth due to a low baseline from the previous year and an increase in bus orders, the industry faced obstacles such as wholesale pressures, government policy impacts, and negative market sentiment.

On a positive note, strong activity in the market loads, cement, iron ore, and coal sectors contributed to the industry's performance.

According to the latest FADA Sales Report, combined CV sales reached 83,059 units in May 2024 compared to 79,807 units sold in May 2023. This shows there is an increase of 4.07% in YOY sales. However, there is a decline of 8.43% in MoM sales. In April 2024, 90,707 units of commercial vehicles were sold.

Commercial Vehicle Segment-wise Sales in May’24

LCV Segment

The Light Commercial Vehicle (LCV) segment sold 45,712 units in May 2024 compared to 42,351 in May 2023. A total of 47,009 units were sold in April 2024. There is a decline of 2.76% in MoM sales but a growth of 7.94% in YoY sales.

MCV Segment

The Medium Commercial Vehicle (MCV) category sold 6,871 units in May 2024 compared to 6,229 in May 2023. A total of 6,704 units were sold in April 2024. There is a growth of 2.49% in MoM sales and 10.31% in YoY sales.

HCV Segment

The Heavy Commercial Vehicle (HCV) category sold 26,306 units in May 2024 compared to 27,184 in May 2023. A total of 32,191 units were sold in April 2024. There is a decline of 18.28% in MoM sales and 3.23% in YoY sales.

Others Segment

All remaining segments of the CV category sold 4,170 units in May 2024 compared to 4,043 in May 2023. A total of 4,803 units were sold in April 2024. There is a decline of 13.18% % in MoM sales and a growth of 3.14% in YoY sales.

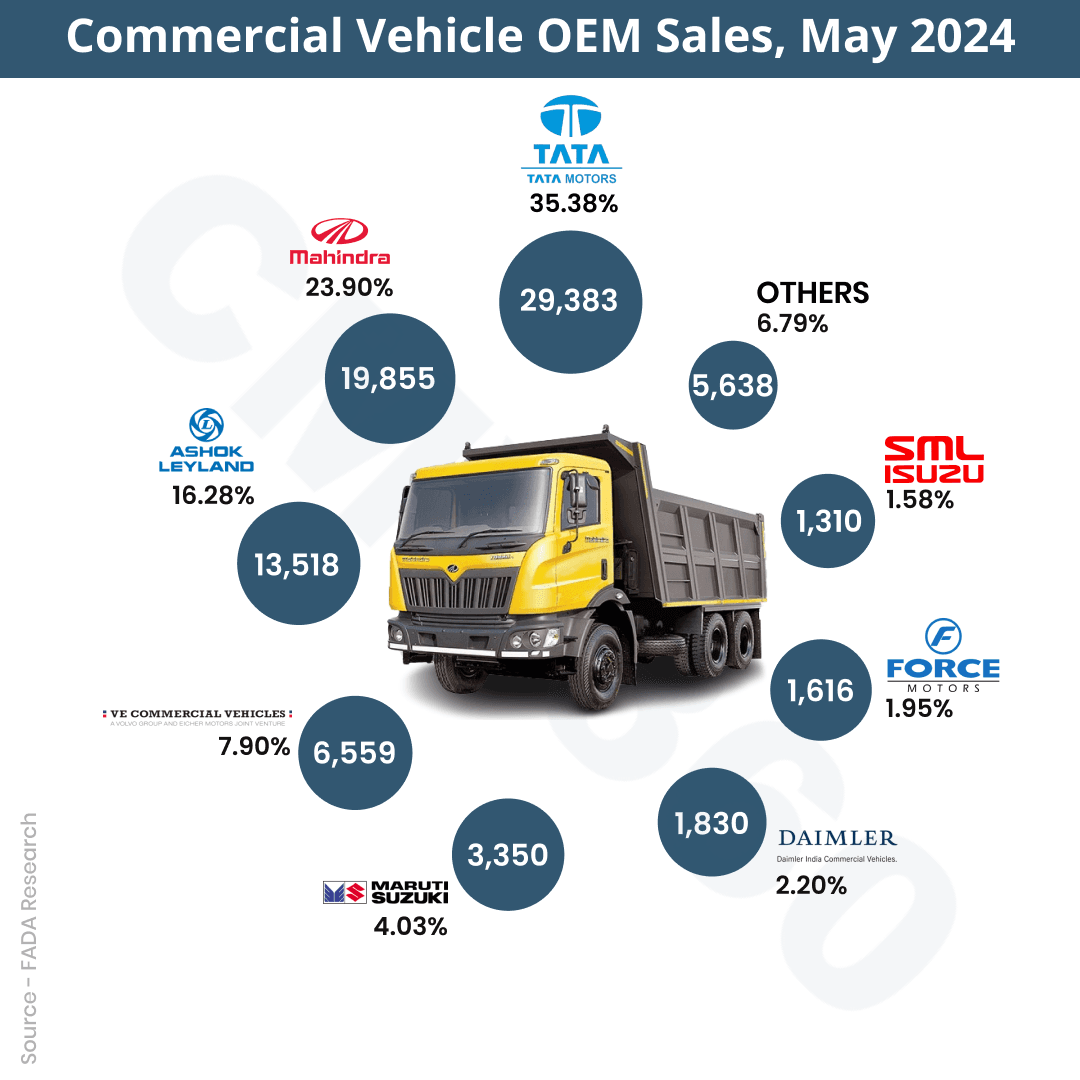

OEM Wise CV Sales Data

In May 2024, the commercial vehicle market saw significant ups and downs, with some companies gaining a larger share compared to last year.

Tata Motors emerged as the leader, selling 29,383 vehicles, and capturing 35.38% of the market, up from 33.74% in May 2023.

Mahindra & Mahindra followed with 19,855 vehicles sold, securing 23.90% of the market share, an increase from last year's 21.61%.

Ashok Leyland sold 13,518 vehicles, holding 16.28% of the market. However, this was a decrease from 18.19% in May 2023.

VE Commercial Vehicles experienced a drop, selling 6,559 vehicles, which gave them a 7.90% market share, down from 9.06% last year.

Maruti Suzuki sold 3,350 vehicles, representing 4.03% of the market, slightly down from 4.40% in May 2023.

Daimler India maintained a stable position, selling 1,830 vehicles for a 2.20% market share, almost the same as last year's 2.28%.

Force Motors saw growth, selling 1,616 vehicles and capturing 1.95% of the market, up from 1.52% in May 2023.

SML Isuzu sold 1,310 vehicles, holding 1.58% of the market, a slight increase from 1.52% last year.

Other manufacturers collectively sold 5,638 vehicles, making up 6.79% of the market, down from 7.68% in May 2023.

Overall, the total sales for May 2024 reached 83,059 vehicles, an increase from 79,807 vehicles sold in May 2023.

Also Read: FADA Sales Report April 2024: CV experienced a modest growth of 2% YoY

CMV360 Says

While it's positive to see overall growth in commercial vehicle sales compared to last year, the decline in month-on-month sales indicates that there may be some challenges affecting the industry. Factors like elections and extreme weather conditions could have impacted sales in May.

However, the growth in certain segments and the performance of leading manufacturers show resilience in the market. It will be important for the industry to navigate through these challenges and capitalize on opportunities for sustainable growth.