Ad

Ad

FADA Sales Report August 2024: CV Segment Experienced decline of 6.05% YOY

Key Highlights:

- Commercial vehicle sales in August 2024 dropped by 6.05% year-over-year.

- Total CV sales were 73,253 units, down from 77,967 units in August 2023.

- Sales declined by 8.50% month-over-month from July 2024.

- Light Commercial Vehicles (LCVs) saw a 6.10% decrease year-over-year.

- Tata Motors held the largest market share at 33.88%, though it decreased from last year.

FADA, the Federation of Automobile Dealers Association, has shared the commercial vehicle sales data for August 2024. The CV segment experienced a decline of 6.05% year over year.

According to the latest FADA Sales Report, combined CV sales totalled 73,253 units in August 2024, down from 77,967 units in August 2023. Additionally, there was a decline of 8.50% in Month-on-Month (MoM) sales compared to July 2024, when 80,057 units were sold.

Commercial Vehicle Sales in August 2024: Category-Wise Breakdown

Light Commercial Vehicles (LCVs)

In August 2024, the LCV segment sold 42,496 units, down 6.26% from July 2024, which recorded 45,336 units. On a year-on-year basis, LCV sales declined by 6.10% compared to 45,257 units in August 2023.

Medium Commercial Vehicles (MCVs)

The MCV segment sold 6,137 units in August 2024, marking a 13.85% drop from July’s 7,124 units. Compared to August 2023, when 6,173 units were sold, the sales decreased slightly by 0.58%.

Heavy Commercial Vehicles (HCVs)

HCV sales stood at 21,221 units in August 2024, showing an 11.82% decline from the 24,066 units sold in July. Year-on-year, the segment dropped by 8.19% compared to 23,114 units sold in August 2023.

Others (Small Commercial Vehicles and Other Segments)

In this category, 3,399 units were sold in August 2024, down 3.74% from July 2024's 3,531 units. The year-on-year change was minimal, with a 0.70% decrease compared to 3,423 units sold in August 2023.

Each category has seen a sales drop, highlighting industry-wide challenges.

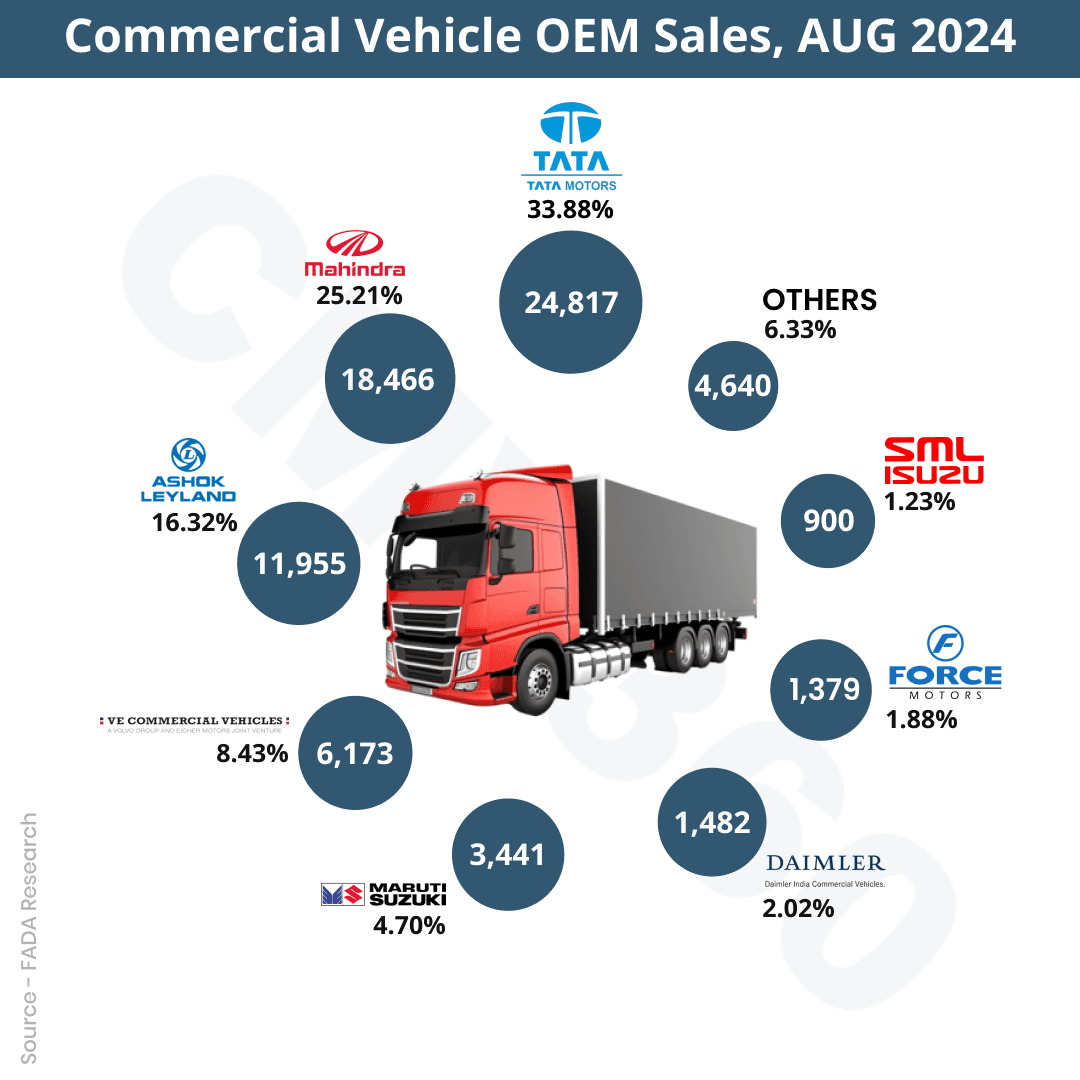

OEM Wise CV Sales Figures

In August 2024, Tata Motors Ltd hold a 33.88% market share with 24,817 units sold, down from 36.17% in August 2023 when they sold 28,198 units.

Mahindra & Mahindra Limited achieved a 25.21% market share. In august 2024, the company sold 18,466 units, compared to 19216 units sold in August 2023.

Ashok Leyland Ltd secured a 16.32% market share. In August 2024, the company sold 11,955 units, compared to 12,136 units in August 2023.

VE Commercial Vehicles Ltd improved its market share to 8.43% with 6,173 units sold, compared to 7.33% and 5,717 units in August 2023.

Maruti Suzuki India Ltd experienced market share increase to 4.70% with 3,441 units sold, up from 4.20% and 3,277 units in August 2023.

Daimler India Commercial Vehicles Pvt. Ltd also saw a rise in market share to 2.02%, selling 1,482 units compared to 1.93% and 1,503 units last year.

Force Motors Limited’s market share decreased slightly to 1.88% with 1,379 units sold, down from 1.96% and 1,527 units in August 2023.

SML Isuzu Ltd experienced a small increase in market share to 1.23%, with 900 units sold compared to 1.15% and 895 units last year.

The ‘Others’ category saw its market share fall to 6.33% with 4,640 units sold, down from 7.05% and 5,498 units in August 2023.

Overall, the total commercial vehicle market in August 2024 consisted of 73,253 units, reflecting a decline from 77,967 units sold in August 2023.

Also Read: FADA Sales Report July 2024: CV Segment Experienced growth of 5.93% YOY.

CMV360 Says

The drop in commercial vehicle sales for August 2024 reflects a tough market environment for the industry. Tata Motors' decline in market share indicates increased competition, while Mahindra & Mahindra and Ashok Leyland have made modest gains. This situation emphasizes the need for manufacturers to stay agile and responsive to market shifts to remain competitive.

News

Yokohama India Launches 'Easy Drive' No-Cost EMI Program for Premium Tyres

Under the 'Easy Drive' program, customers can choose from Yokohama’s premium tyre ranges, including the ADVAN, Geolandar, and BluEarth series, without any upfront payment...

25-Mar-25 09:48 AM

Read Full NewsCityflo Expands Fleet with 100 New Custom-Built Buses in Partnership with VECV

Cityflo plans to deploy 500 buses across five metro cities by 2026. Cityflo’s smaller and more agile buses are designed to run smoothly through the city's crowded roads....

25-Mar-25 09:16 AM

Read Full NewsACMA & Guidance Tamil Nadu Host Event Showcasing Tamil Nadu’s Automotive Strength

The Automotive Component Manufacturers Association of India hosted an event in Chennai. The Title of the event was ‘Unveiling India’s New Automotive Hub: Where Wheels of ...

24-Mar-25 10:20 AM

Read Full NewsMahindra to Hike Prices of SUVs and Commercial Vehicles by Up to 3%, Starting April 2025

Mahindra’s latest price revision follows similar actions taken by other manufacturers to manage their operating costs....

24-Mar-25 09:09 AM

Read Full NewsContinental India Shines at ACMA Excellence Awards 2024

Continental’s awards highlight its efforts to improve operations through digitalisation and process enhancements....

24-Mar-25 06:32 AM

Read Full NewsSML Isuzu Appoints Yasushi Nishikawa as New Managing Director and CEO, Effective April 17, 2025

SML Isuzu announces the appointment of Yasushi Nishikawa as its new Managing Director and CEO, effective April 17, 2025, following the resignation of Junya Yamanishi....

21-Mar-25 11:54 AM

Read Full NewsAd

Ad

Latest Articles

AC Cabin Trucks in India 2025: Merits, Demerits, and Top 5 Models Explained

25-Mar-2025

Benefits of Buying Montra Eviator In India

17-Mar-2025

Top 10 Truck Spare Parts Every Owner Should Know

13-Mar-2025

Top 5 Maintenance Tips for Buses in India 2025

10-Mar-2025

How to Improve Electric Truck Battery Range: Tips & Tricks

05-Mar-2025

Top 5 Tata Signa Trucks in India 2025

03-Mar-2025

View All articles

Registered Office Address

Delente Technologies Pvt. Ltd.

M3M Cosmopolitan, 12th Cosmopolitan,

Golf Course Ext Rd, Sector 66, Gurugram, Haryana

pincode - 122002

Join CMV360

Receive pricing updates, buying tips & more!

Follow Us

COMMERCIAL VEHICLE BUYING BECOMES EASY AT CMV360

CMV360 - is a leading commercial vehicle marketplace. We helps consumers to Buy, Finance, Insure and Service their commercial vehicles.

We bring great transparency on pricing, information and comparison of tractors, trucks, buses and three wheelers.