Ad

Ad

Statistics for Mini Trucks Sales in the Last 3 Years

The sales of mini trucks in India have risen in recent years with accurate benchmarks. Generally, mini truck sales in India is considered one of the crucial data to understand the progress of the Indian economy. It gives information about business growth, infrastructure enhancement, and increased nationwide connectivity by road.

The mini-truck market is mainly captured by three big giant companies Tata, Mahindra, and Supro. Tata's Ace, Mahindra's Jeeto, and Supro are India's three most selling mini trucks. These trucks are affordable, work well in the Indian environment, and require less maintenance.

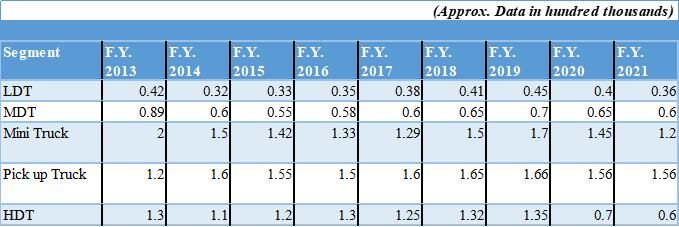

In 2013, it was expected that the mini truck sales would increase in upcoming years by 14%, which was as little as 3,00,000 units. However, due to less opportunity for proper mini truck finance, growth forecast, and other challenges, this segment has declined continuously. At the start of 2018, the mini-truck sales in India rose by 9% and achieved sales of over 29,600 units. In the same year, it increased its sales by 17% and generated 52,700 mini truck sales.

However, this market has to keep seeing several ups and downs in the market. And to understand the same, we will discuss the mini truck sales in the last three years with an in-depth analysis. If you want to learn about the statistics of mini truck sales, you can keep scrolling through this post here.

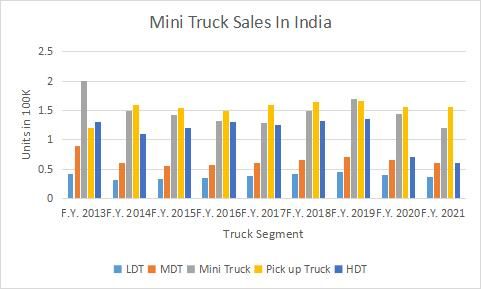

Table Displaying Sale of Mini Trucks in India from F.Y. 2013 to F.Y. 2021

Analysis of Mini Truck Sales in India in the Last 3 Years

Tata Motors is the leading player in selling the highest number of mini trucks in India. It had a 43% market share in 2021 for selling the highest number of mini trucks. But it saw an 18% sales drop in the market in the last ten years. At the same time, the company had a CAGR of -6.6% from 2012 to 2021. At the same time, Mahindra, Isuzu, Maruti Suzuki, and Ashok Leyland saw growth in their sales. And Ashok Leyland, Mahindra, and Maruti Suzuki generated 7%, 9%, and 5% market growth, respectively.

These companies increased their sales and revenue by launching new division vehicles, offering competitive pricing, and influencing the new generation with attractive offers. Hence, these companies have been seeing continuous growth in their market share and sales for the last few years. Their mini trucks are suitable for transporting parcels, poultry, white goods, and even auto parts.

Tipper Division of Commercial Vehicle

In 2021, tipper decision vehicles had a 9% market share, and the tractor division had only a 3% market share. This year Tata Motors again ruled the market and lost some market share and ended at 57%. Ashok Leyland had second place with a 29% market share in this segment. On the other hand, Eicher saw a 3% growth in the tipper segment and earned an 8% market share.

If we talk about the heavy-duty tipper segment, Tata Motors has over 60% market share. But for the premium tipper segment, Volvo owns over 90% share in the market. The rigid Haulage division is doing great in India because it generates 90% sales.

HDT segment

Based on the CAGR report for 2012-21, all subdivisions of the truck industry received a negative score except pickup. This segment gained an 8% CAGR score, whereas other segments got -6% to -7%. In 2016, the HDT segment had over 35% market share in the truck industry. But in 2021, it lost significant market share and ended at 21%. Tata Motors is again at the top, but it lost a 12% market share in the last ten years. But companies like Eicher raised their market share and managed to get almost 7% share in the market. This segment also had the most impact on 2019 market conditions. And therefore, it reduced its market by 50% in 2020 and 15% in 2021.

MDT segment

Tata is the major player in the truck industry; whether its entry-level segment or mid-range segment, it has a significant share in the market. However, Eicher motors give fair competition in the MDT segment, but still, for over three years, Tata has maintained its highest market share. Currently, Tata holds a 46% market share for the MDT segment in India. And Eicher had a 31% market share during 2021 that kept it in second place. In the last ten years, Ashok Leyland gained a 9% share in the market and a 4% CAGR.

LDT

When Tata started capturing the LDT segment by launching new mini trucks, it had almost 71% market share. But due to heavy competition and many alternatives, it managed to have a 56% market share in 2021. it lost 14% market share in the last ten years, whereas Eicher Motors grew and earned 29% market share. It was suitable for Eicher motors because it started with 13% and gained 16% market share in the last ten years.

Mini Trucks

Mini Trucks is one of the most significant segments for several sales and revenue. However, pandemic time affected this segment and decreased its market size. Many customers of this segment shifted to purchasing pickup trucks. And it was one of the reasons why the pickup segment generated a positive CAGR score. Earlier, Tata Motors and Mahindra were both significant players where Tata was leading. But after the entrance of Maruti Suzuki, Tata and Mahindra lost 9% and 11% market share, respectively.

**Growth of Mini Truck Sales in 2022 **

We discussed the mini truck sales in the last three years with other segments. Now let's also look at present trends to understand the market scenario for this segment. Currently, the market sale of mini trucks is increasing. In March 2021, the commercial vehicle generated nearly 80,000 unit sales; this March, this segment crossed 1,16,000 unit sales. It shows now that entry-level customers to mid-range buyers are showing interest in mini trucks.

Maruti Suzuki also saw increased sales this year. Not only this, but Tata also sold over 40,000 units with a growth of 43% in market share. Mahindra generated 17,400 unit sales in March and saw 11,900 units more sales than last year. Other companies like Ashok Leyland and VE commercial vehicles also reported significant sales growth this year. You can look at the pie chart to understand the sales of different companies for truck sales.

So, here you can see that Tata has significant sales compared to other companies, and it sold 33,900 units. At the same time, Mahindra and Ashok Leyland sold 17,349 and 11,676 units, respectively.

Conclusion

Mini trucks are an important segment of the Indian economy as it helps farmers and companies to bring essential raw materials and supply essential goods to customers. Nowadays, mini trucks are getting used in various sectors such as eCommerce, high farm output, and even in providing transportation services. Based on current stats, mini truck sales and market share will increase in 2022. Because now the Indian economy is booming and recovering from past losses.

Therefore, it will positively impact the mini-truck market and help companies offer competitive benefits and attract new buyers.

News

CMV360 Weekly Wrap-Up | 20th–26th April 2025: Key Developments in Sustainable Mobility, Electric Vehicles, Tractor Leadership, Technological Innovation, and Market Growth in India

This week’s wrap-up highlights India’s advancements in electric vehicles, sustainable logistics, tractor leadership, AI-driven farming, and market growth....

26-Apr-25 07:26 AM

Read Full NewsChennai MTC to Get 625 Electric Buses from July, TN to Add 3,000 New Buses Soon

Tamil Nadu (TN) to add 8,129 new buses, including electric and CNG, starting with 625 e-buses in Chennai from July....

25-Apr-25 10:49 AM

Read Full NewsMontra Electric Opens e-SCV Dealership in Uttar Pradesh with MG RoadLink

Montra Electric opens its first e-SCV dealership in Uttar Pradesh, offering EVIATOR sales and service support in Lucknow with MG RoadLink....

25-Apr-25 06:46 AM

Read Full NewsGreenLine Deploys LNG Fleet for Bekaert, Aiding India’s Clean Transport Goals

GreenLine and Bekaert launch LNG truck fleet to cut emissions and support India’s shift to a gas-based economy....

24-Apr-25 11:56 AM

Read Full NewsIndia to Introduce Safety Ratings for Trucks and E-Rickshaws

The announcement was made during a two-day workshop on vehicle and fleet safety in Faridabad, organized by the Global New Car Assessment Program (GNCAP) and the Institute...

24-Apr-25 11:09 AM

Read Full NewsMontra Electric Opens First e-SCV Dealership in Rajasthan

The dealership has been established through a collaboration with Ensol Infratech Pvt Ltd. It follows a 3S model—offering Sales, Service, and Spares along with charging su...

24-Apr-25 07:11 AM

Read Full NewsAd

Ad

Latest Articles

Summer Truck Maintenance Guide in India

04-Apr-2025

AC Cabin Trucks in India 2025: Merits, Demerits, and Top 5 Models Explained

25-Mar-2025

Benefits of Buying Montra Eviator In India

17-Mar-2025

Top 10 Truck Spare Parts Every Owner Should Know

13-Mar-2025

Top 5 Maintenance Tips for Buses in India 2025

10-Mar-2025

How to Improve Electric Truck Battery Range: Tips & Tricks

05-Mar-2025

View All articles

Registered Office Address

Delente Technologies Pvt. Ltd.

M3M Cosmopolitan, 12th Cosmopolitan,

Golf Course Ext Rd, Sector 66, Gurugram, Haryana

pincode - 122002

Join CMV360

Receive pricing updates, buying tips & more!

Follow Us

COMMERCIAL VEHICLE BUYING BECOMES EASY AT CMV360

CMV360 - is a leading commercial vehicle marketplace. We helps consumers to Buy, Finance, Insure and Service their commercial vehicles.

We bring great transparency on pricing, information and comparison of tractors, trucks, buses and three wheelers.