Ad

Ad

The Kisan Credit Card Scheme: Providing Timely Access to Credit for Farmers

The Kisan Credit Card scheme, launched in 1998 by the National Bank for Agriculture and Rural Development (NABARD), is a government initiative aimed at providing farmers with easy access to formal credit. The scheme is designed to meet the credit requirements of farmers engaged in agriculture, fisheries, and animal husbandry.

The KCC scheme offers short-term loans to farmers, enabling them to purchase equipment and meet other expenses. Farmers can benefit from the scheme's low-interest rates, with interest starting at just 2% and averaging at 4%, which is significantly lower than the interest rates charged for regular bank loans. Additionally, KCC loans can be repaid based on the harvesting period of the crop for which the loan was granted.

With the Pradhan Mantri Kisan Samman Nidhi Yojana (PM-KISAN) linking to the PM Kisan Credit Cards, farmers can now apply for a loan of up to Rs.3 lakh at a 4% interest rate. The process of obtaining a KCC has also become more accessible for PM-KISAN beneficiaries.

Overall, the Kisan Credit Card scheme is a crucial step towards ensuring that farmers have timely access to formal credit, and can support their agricultural, animal husbandry, and fishery needs, while also improving their financial stability.

Kisan Credit Card Benefits and Features

The Kisan Credit Card scheme provides a range of features and benefits to farmers including access to credit for agricultural and allied activities. This includes investment credit for requirements such as dairy animals and pump sets, as well as loans of up to Rs.3 lakh and produce marketing loans.

The scheme also provides insurance coverage for cardholders in the case of permanent disability or death, with a cover of up to Rs.50,000, and a cover of Rs.25,000 for other risks. Eligible farmers will receive a savings account with an attractive interest rate, as well as a smart card and debit card, in addition to their Kisan Credit Card.

Flexible repayment options are available, and the disbursement procedure is hassle-free. The scheme provides a single credit facility or term loan for all agricultural and ancillary requirements, and assists farmers in purchasing fertilizers, seeds, etc., and availing cash discounts from merchants and dealers.

Credit is available for a period of up to three years, with repayment made once the harvest season is over. Additionally, no collateral is required for loans amounting up to Rs.1.60 lakh. These features and benefits make the Kisan Credit Card scheme an important tool for farmers seeking to finance their agricultural activities and expand their operations.

Interest Rate on Kisan Credit Card

- The interest rate on the Kisan Credit Card varies across different banks and credit limits.

- The interest rate can range from as low as 2% to an average of 4%.

- The government offers subsidies and schemes for farmers to reduce the interest rate, based on their repayment history and credit history.

- Other charges such as processing fees, insurance premium (if applicable), and land mortgage deed charges are at the discretion of the issuing bank.

Eligibility Criteria for Kisan Credit Card (KCC)

The Kisan Credit Card loan scheme has certain eligibility criteria, which are as follows:- Any individual farmer who is an owner-cultivator is eligible.- People who belong to a group and are joint borrowers can apply. The group has to be owner-cultivators.- Sharecroppers, tenant farmers, or an oral lessee are eligible for the KCC.- Self-help groups (SHG) or joint liability groups (JLG) of sharecroppers, farmers, tenant farmers, etc. are eligible.- Farmers involved in the production of crop or allied activities such as animal husbandry along with non-farm activities such as fishermen can apply for the scheme.

The scheme for fisheries and animal husbandry has designated the following groups as eligible beneficiaries:

For Inland Fisheries and Aquaculture: Fish farmers, fishers, Self-Help Groups (SHGs), Joint Liability Groups (JLGs), and women's groups. To qualify as a beneficiary, you must either own or lease a property related to fisheries. This includes owning or leasing a pond, an open water body, a tank, or a hatchery, among others.

For Marine Fisheries: You must own a registered boat or any other type of fishing vessel, and possess the necessary license or permissions to fish in estuaries or the sea.

For Poultry: Individual farmers or joint borrowers, Self-Help Groups (SHGs), Joint Liability Groups (JLGs), and tenant farmers of sheep, rabbits, goats, pigs, birds, and poultry who own, rent or lease sheds.

For Dairy: Farmers, dairy farmers, Self-Help Groups (SHGs), Joint Liability Groups (JLGs), and tenant farmers who own, lease, or rent sheds.

Documents Required for Kisan Credit Card (KCC)

To apply for the KCC Loan Scheme, the following documents are necessary:

- A completed and signed application form.

- A copy of the applicant's identity proof, such as Aadhaar card, PAN card, Voter ID, driving licence, etc.

- A copy of the address proof document, such as Aadhaar card, PAN card, Voter ID, driving licence, which should have the applicant's current address to be considered valid.

- Land documents.

- A passport-size photograph of the applicant.

- Other documents as requested by the issuing bank, such as security Post Dated Cheques (PDCs).

Application Process for the Kisan Credit Card

The Kisan Credit Card application process can be completed through both online and offline methods. Here are the steps to follow:

Online:- Go to the website of the bank where you want to apply for the Kisan Credit Card scheme.- Select the Kisan Credit Card option from the list of options.- Click on the 'Apply' button, which will redirect you to the application page.- Fill in the required details on the form and click on 'Submit'.- An application reference number will be sent to you upon submission.- If you are eligible, the bank will contact you within 3-4 working days for further processing.

Offline:- You can visit the bank branch of your choice to apply for the Kisan Credit Card.- Alternatively, you can download the application form from the bank's website.- Complete the form and submit it to the bank representative.- The loan officer at the bank will help you with the loan amount once the formalities are completed.

PM Kisan Samman Nidhi Scheme

The Indian government launched the PM Kisan Samman Nidhi Scheme, which provides income support of up to Rs. 6,000 annually to all farmers. This scheme was introduced during the 2019 Interim Union Budget of India.

After the Budget 2020, the government has taken measures to ensure that institutional credit is more accessible to all farmers in the country. To achieve this, the Kisan Credit Card (KCC) Scheme and the Kisan Samman Nidhi Scheme have been combined. As a result, all beneficiaries of the Kisan Samman Nidhi Scheme are eligible to receive a Kisan Credit Card.

Application process for a Kisan Credit Card under the PM Kisan Samman Nidhi Scheme

The process to apply for a Kisan Credit Card under the PM Kisan Samman Nidhi Scheme is as follows:

- Visit the website of any commercial bank and download the one-page application form.

- Fill in your basic information such as the type of crops grown and land records.

- Submit the completed form to the nearest Common Service Center (CSC).

- The CSC will forward your application to all eligible banks.

Longer loan Repayment Periods in KCC

Banks offering Kisan Credit Card (KCC) loans in India are considering longer loan repayment periods due to the significant pressure on the agriculture sector. At a state-level bankers' consultancy meeting in West Bengal, it was proposed to increase the loan repayment cycle from 12 months to 36 or 48 months.

Moreover, the banks have suggested that farmers be allowed to access additional loans even after failing to repay the previous loan, provided they service the interest. Public sector banks have initiated a three-stage consultation process based on the directions of the Department of Financial Services. The consultation process will focus on nine key issues, including credit for MSMEs and the agricultural sector, digital banking, direct transfer of benefits, and education loans. While the previous meeting was an intra-bank meet, the upcoming meeting will be an inter-bank meet at a state level.

Some Popular Kisan Credit Cards (KCC) by Banks

Banks offer different Kisan Credit Cards that have various features, including credit limit and maximum tenure. Here are some of the top Kisan Credit Cards offered by different banks in India:

Axis Kisan Credit Card: The credit limit for this card is up to Rs.2.50 lakh in the form of a loan against the card. The maximum tenure for cash credit is up to 1 year, and up to 7 years for term loans.

BOI Kisan Credit Card: This card offers a credit limit of up to 25% of the farmer's estimated income, but not exceeding Rs.50,000. The maximum tenure is not applicable.

SBI Kisan Credit Card: The credit limit for this card is based on the crop cultivation and cropping pattern. The maximum tenure for this card is 5 years.

HDFC Kisan Credit Card: This card offers a credit limit of up to Rs.3 lakh, and the maximum tenure is 5 years.

How to Check Kisan Credit Card Balance

To apply for a Kisan Credit Card, you can now complete the process online through any bank that issues KCCs. To check the balance of your Kisan Credit Card, you can contact the customer care of the bank that issued your card. Alternatively, you can log into the bank's website and check your Kisan Credit Card balance through their portal.

Frequently Asked Questions (FAQs) on Kisan Credit Card Loan Scheme

Q1. What is a crop loan and how is it related to KCC?

Ans. Crop loans are types of loans provided to farmers to meet their working capital needs. Kisan Credit Card (KCC) is a type of crop loan scheme offered by banks. However, KCC loans can be utilized for other purposes as well.

Q2. What is the validity period of Kisan Credit Card?

Ans. The validity period of KCC is five years. The tenure for which the loan is sanctioned depends on the activity for which the loan is availed.

Q3. What is the age requirement for Kisan Credit Card?

Ans. The minimum age requirement for KCC is 18 years, and the maximum age limit is 75 years. If the applicant is a senior citizen, a legal heir must be included as a co-borrower.

Q4. What is the interest rate on Kisan Credit Card?

Ans. The interest rate for KCC is decided by the bank, but according to the KCC circular dated 20 April 2012, the interest rate is 7% per annum on short-term credit with a maximum principal limit of Rs.3 lakh.

Q5. How does the bank determine the credit limit on a Kisan Credit Card?

Ans. The credit limit offered on KCC for the first year is based on crop cultivation according to the proposed scale of finance and cropping pattern, household and post-harvest consumption requirements, and expenses related to crop and personal insurance schemes.

Q6. Is a revolving credit facility available on Kisan Credit Card?

Ans. Yes, KCC loans have a revolving cash credit facility available for unlimited withdrawals and repayments made within the credit limit.

Q7. Why was the KCC scheme introduced?

Ans. The KCC scheme was introduced to ensure that farmers in the agriculture, fisheries, and animal husbandry sectors can access short-term credit and meet their credit requirements for various expenses, including the purchase of equipment.

Features & Articles

Tata Ace Pro vs Tata Ace Gold: Which Mini Truck is Better for Your Business in 2025?

Compare Tata Ace Pro and Tata Ace Gold in detail. Know their price, specs, performance, and features to choose the best mini truck for your business in 2025....

13-Nov-25 12:36 PM

Read Full NewsTop 5 Buses in India 2025: Most Popular and Advanced Models for Comfortable Travel

Discover India’s top buses in 2025. Compare features, prices, and uses of the best models from Volvo, Tata, Ashok Leyland, SML Isuzu, and Force Motors....

06-Nov-25 10:46 AM

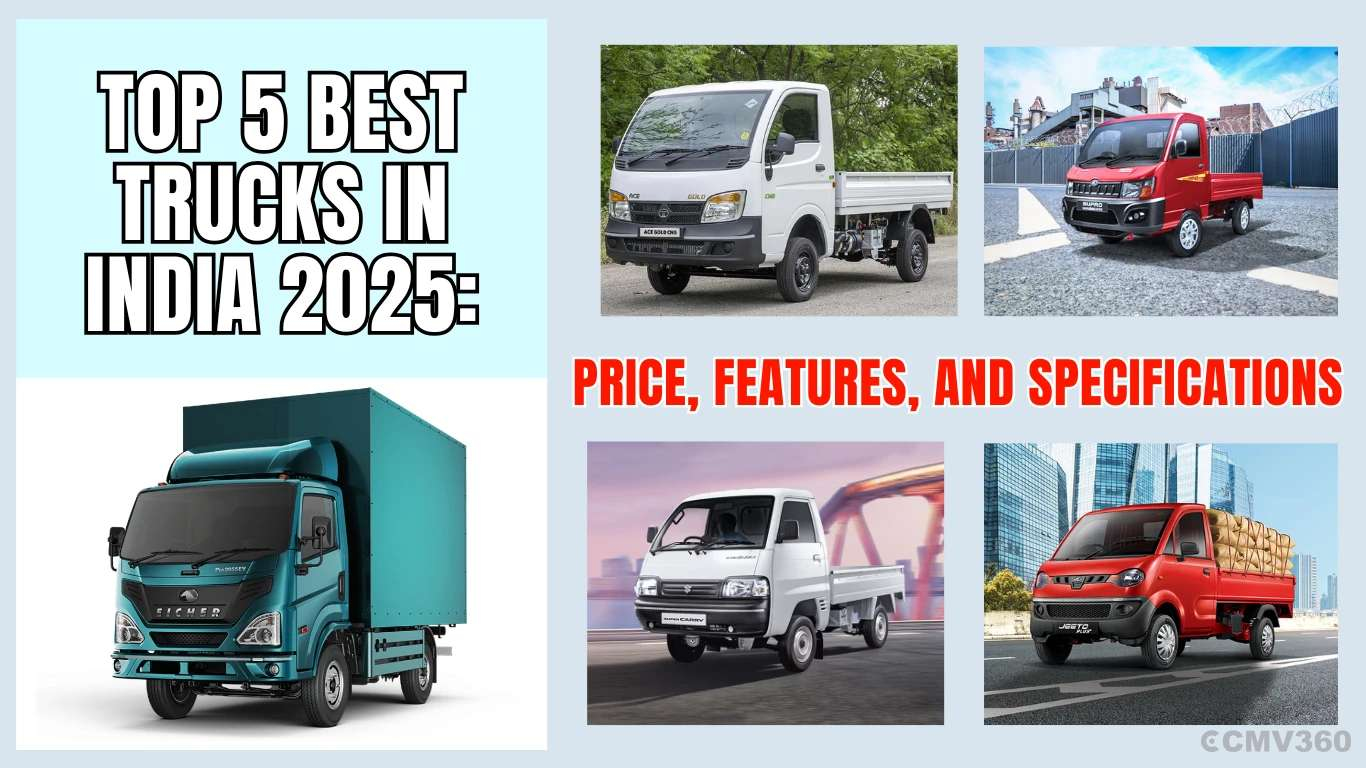

Read Full NewsTop 5 Best Trucks in India 2025: Price, Features, and Specifications

Explore the Top 5 Best Trucks in India 2025 with price, mileage, and features. Compare mini trucks, pickups, and electric trucks ideal for small businesses and transport ...

31-Oct-25 12:39 PM

Read Full NewsEuler Turbo EV1000 vs Tata Ace Gold Diesel: The 1-Tonne Battle Between Electric and Diesel Trucks

Compare the Euler Turbo EV1000 and the Tata Ace Gold Diesel. See performance, range, price, and total cost insights to find which 1-tonne truck offers better value and sa...

28-Oct-25 07:16 AM

Read Full NewsTop Truck Brands in India 2025: Complete Guide to Models, Features & Market Leaders

Explore the leading truck brands in India 2025. Discover models, features, and innovations from Tata, Mahindra, Ashok Leyland, BharatBenz, Eicher, and more shaping India’...

13-Oct-25 10:09 AM

Read Full NewsTop 5 Pickup Trucks in India 2025 – Powerful, Reliable, and Built for Every Business

Explore the top 5 pickup trucks in India 2025, including Tata, Mahindra, Isuzu, and Jupiter models. Compare prices, features, mileage, and payloads for the best commercia...

07-Oct-25 07:26 AM

Read Full NewsAd

Ad