Ad

Ad

Agricultural Loans in India - An overview of the National Bank for Agriculture and Rural Development (NABARD)

Agriculture serves as the foundation of the Indian economy, and it's no surprise that financial institutions extend various forms of monetary aid to farmers nationwide. Agricultural loans are available for a range of farming-related activities.

Types of Agricultural Loans Available in India

Agricultural loans in India can be utilized for the following activities:- Financing day-to-day operations- Purchasing farm machinery like tractors and harvesters- Acquiring land- Storage needs- Loans for marketing agricultural products- Expansion and growth

In addition to loans, farmers may also qualify for grants and subsidies that protect them in the event of crop damage or loss. These forms of financial assistance are not limited to food crop cultivation, but are available to individuals engaged in related agricultural sectors such as horticulture, aquaculture, animal husbandry, silk farming, apiculture, and floriculture.

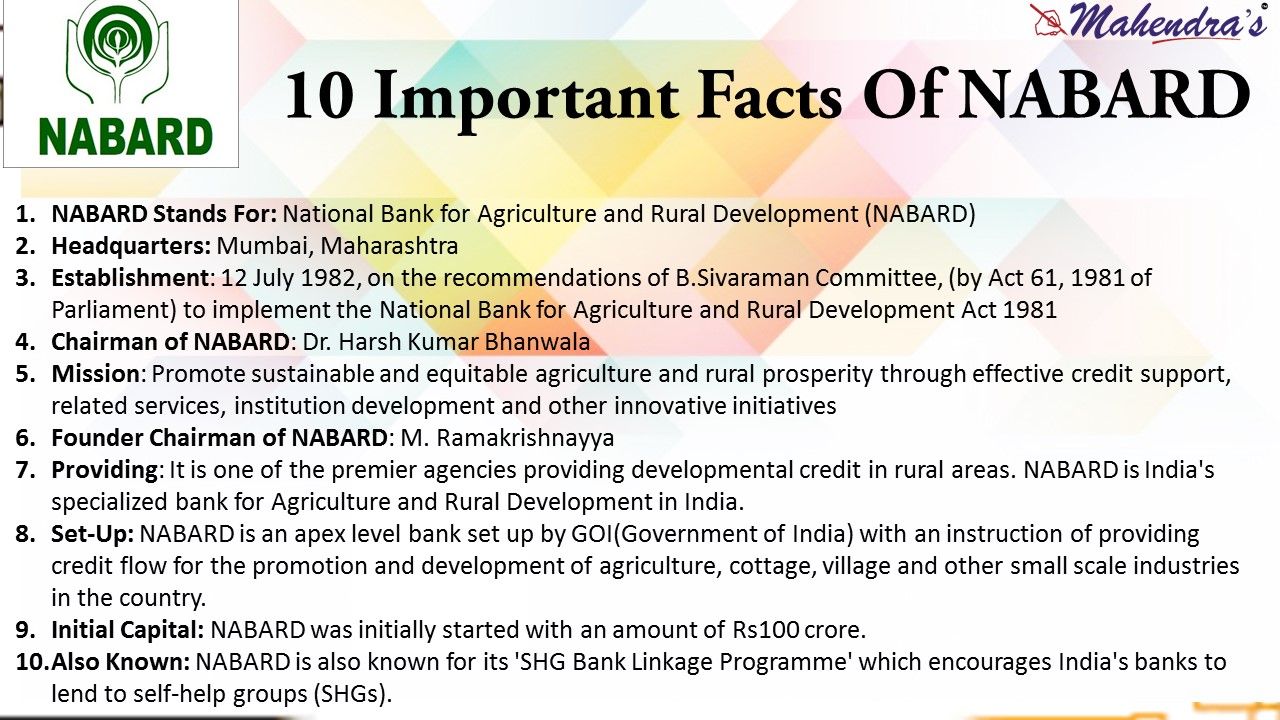

National Bank for Agriculture and Rural Development (NABARD)

The National Bank for Agriculture and Rural Development (NABARD) is a pioneering financial institution in India that has been instrumental in providing critical financial support to farmers and rural communities. In the early 1980s, NABARD set the trend for boosting the rural economy and agriculture through financial credit.

Today, all other banks across India that offer credit in the field of agriculture fall under the purview of NABARD. Working in conjunction with the Government of India, NABARD has launched several innovative schemes that have greatly benefited farmers throughout the country.

The most notable scheme launched by NABARD is the Kisan Credit Card (KCC). The KCC is a credit system specifically designed to meet the short-term credit requirements of farmers. Under this scheme, farmers are provided with credit for crop production, livestock rearing, and other allied agricultural activities. The KCC offers flexible repayment terms and interest rates, making it an attractive option for farmers in need of credit.

NABARD's other initiatives include setting up regional rural banks, providing credit facilities to self-help groups, and implementing various capacity-building programs. These programs have helped to create a more robust and sustainable agriculture sector in India, ensuring that farmers have access to the credit and support they need to thrive.

Kisan Credit Card Scheme in India

The Kisan Credit Card (KCC) scheme was introduced by Indian banks in 1998 as a means of providing financial support to the agricultural sector. The KCC offers several features and benefits to farmers and the quantum of the loan depends on various factors such as the cost of cultivation and farm maintenance.

This scheme has been particularly beneficial to farmers who are not familiar with banking practices and protects them from informal and harsh creditors that may lead to excessive debt. The KCC card can be used by farmers to withdraw funds for crop production and domestic needs.

Applying for a Kisan Credit Card is a simple and hassle-free process that requires minimal documentation. It also provides crop insurance coverage and subsidies on interest payments. Under the KCC scheme, farmers can borrow funds at an interest rate of 7% per annum for amounts up to Rs. 3 lakh.

The Kisan Credit Card is linked to the farmer's savings account, and all transactions are conducted through a single account. Moreover, any credit balance in the KCC account earns interest, providing additional benefits to farmers.

All farmers are eligible to apply for a KCC, and those interested can visit their nearest bank to obtain more information. The Kisan Credit Card scheme has proven to be a successful initiative in providing much-needed financial support to farmers and has contributed significantly to the growth and development of the Indian agricultural sector.

Other NABARD-Supported Agricultural Loan Schemes

In addition to the Kisan Credit Card, NABARD has developed several other loan schemes that focus on specific agricultural sectors. Some of these schemes are outlined below:

Dairy Entrepreneurship Development Scheme: This scheme promotes the dairy sector by facilitating the creation of modernized dairy farms, promoting calf rearing, providing infrastructure, and upgrading logistical operations to improve the product on a commercial scale. It also generates self-employment opportunities.

Rural Godowns: This scheme aims to help farmers by providing them with godowns to store their produce. This improves their holding capacity, which in turn allows them to sell their produce at fair rates rather than under distress. With a nationalized warehouse system in place, marketing agricultural produce becomes simpler.

Loan Against Warehouse Receipts: Warehouse receipt financing helps prevent distress sales by allowing farmers to store their produce in a WDRA-accredited warehouse and obtain a receipt detailing the quality and quantity of the produce. This receipt can be used to get credit from banks, up to 70 percent of the collateral value.

Solar Schemes: These schemes aim to reduce dependence on grid power by promoting the use of solar equipment, such as replacing diesel pumps with solar ones. Solar equipment has lower operating costs and is environmentally friendly.

Visit the official NABARD website for more details on these schemes, including how to apply for them. Since many of these are subsidy-based schemes, your bank will adjust your loan repayments against the corresponding subsidy you are entitled to through the funds released by NABARD.

Leading Banks that offer Agricultural Loans in India

India has several public-sector banks that are recognized for providing exceptional credit services in the agriculture sector. Here are some of the leading financial institutions:

State Bank of India Agricultural Loans

State Bank of India is a leading financial institution that has been at the forefront of financing projects in the agricultural sector in India. With over 16,000 branches across the country, they have provided credit services to millions of farmers.

SBI offers a range of agricultural loan products such as Kisan Credit Card, gold loans for crop production, and multi-purpose gold loans for agriculture-related activities. The bank also provides loans for farm mechanization, which can be used to purchase equipment like tractors, combine harvesters, and drip irrigation systems. Additionally, loans for dairy, poultry, and fisheries-related activities can also be availed, and credit can be taken against warehouse receipts.

The Debt Swapping Scheme is another notable feature offered by SBI, which provides financial assistance to farmers to help them clear their dues that have been accumulated by taking loans from non-institutional lenders at high interest rates.

Moreover, SBI also offers financial assistance for agricultural marketing, establishing agribusiness and agri clinic centres, and land purchase. These loans and services are available not only at the parent branches but also at their seven associate subsidiaries: State Bank of Bikaner and Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala, State Bank of Travancore, State Bank of Indore, and State Bank of Saurashtra.

If you are interested in availing any of the agricultural loans offered by the State Bank of India, you can visit your nearest SBI branch for more details and application.

HDFC Bank Agricultural Loans

The HDFC Bank provides an array of agricultural loans to farmers and agriculturists, serving multiple purposes from setting up orchards and plantations to boosting commercial horticulture and producing field crops. In addition, the HDFC Bank offers warehouse receipt financing for all farmers and small traders.

Allahabad Bank's Agricultural Loan Services

Allahabad Bank is a nationalized bank in India that offers various loan products to farmers and agriculturists. Their Akshay Krishi scheme offers the Kisan Credit Card, which provides similar benefits to the KCC scheme. This product is available to all farmers, tenant farmers, and cultivator owners.

In addition to the Kisan Credit Card, Allahabad Bank has developed its own unique product known as the Allahabad Bank Potato Growers Credit Card Scheme. This scheme is designed to provide timely financial support to farmers to meet their cultivation requirements.

Furthermore, Allahabad Bank also provides other services like warehouse receipt financing, debt swapping schemes, and the construction of rural godowns. These services can be accessed through any of their branches.

Bank of Baroda Agricultural Loans

When it comes to financing agricultural projects in India, Bank of Baroda is one of the leading institutions that farmers turn to. They offer various schemes that cater to almost all the sectors in agriculture.

Farmers can avail loans to purchase tractors and heavy machinery for day-to-day operations. Additionally, Bank of Baroda offers working capital and funds required to set up or run units involved in dairy, pig farming, poultry, sericulture, rearing of sheep and goat, among others.

Farmers can also opt for four-wheeler loans to manage their farm activities better. Bank of Baroda offers a maximum quantum of Rs. 15 lakh for such loans.

Punjab National Bank's Financial Products for Agriculture

Punjab National Bank offers a wide range of financial products tailored for agricultural purposes. For instance, one can apply for loans to develop wastelands, establish biogas units, or install minor irrigation apparatus. In addition, PNB provides financial assistance to individuals interested in pursuing apiculture (beekeeping).

Moreover, the bank offers warehouse receipt financing and insurance coverage to farmers to mitigate the risks of crop failures caused by natural disasters, diseases, and pests. The bank's Pradhan Mantri Fasal Bima Yojana scheme provides financial aid to farmers during such events. Along with these, PNB also offers other agricultural services like Kisan Credit Card and debt swapping.

Axis Bank's Agricultural Loan Products

Axis Bank is a trusted name in the realm of agricultural finance, offering a range of financial products to support farmers. These include Kisan Credit Card, gold loans, tractor loans, warehouse receipt financing, and loans for constructing rural godowns, among others.

One of Axis Bank's unique offerings is Contract Farming, which facilitates loan agreements between farmers and corporates. The lender disburses the loan amount immediately to produce and supply the crop, all governed by the Fair Practices Lending Code.

When considering agricultural loans, it's important to research and identify the type of loan that best suits your needs, given the variety of loan options available.

Common FAQs on National Bank for Agriculture and Rural Development (NABARD)

Here are some frequently asked questions about National Bank for Agriculture and Rural Development (NABARD):

Q1: What is NABARD and what is its role in rural development?

Ans: NABARD stands for National Bank for Agriculture and Rural Development. It is a development bank established in 1982 to provide credit and other facilities for the promotion and development of agriculture, small-scale industries, cottage and village industries, handicrafts and other rural crafts, and other allied economic activities in rural areas of India.

Q2: Who can avail of loans from NABARD?

Ans: NABARD offers loans and financial assistance to a wide range of beneficiaries, including farmers, rural artisans and entrepreneurs, self-help groups, joint liability groups, rural women, micro, small, and medium enterprises (MSMEs), and other rural development agencies.

Q3: What types of loans does NABARD offer?

Ans: NABARD offers various types of loans and financial assistance for rural development, including long-term loans for agricultural and allied activities, short-term loans for crop production and marketing, loans for agri-processing and value addition, loans for rural infrastructure development, and loans for renewable energy projects, among others.

Q4: How can I apply for a loan from NABARD?

Ans: To apply for a loan from NABARD, you need to submit a loan application along with the required documents to the nearest NABARD branch or regional office. The loan application should be accompanied by a detailed project report (DPR) that outlines the project's objectives, viability, and expected outcomes.

Q5: What is the interest rate for NABARD loans?

Ans: The interest rate for NABARD loans varies depending on the type of loan, loan amount, and other factors. Typically, the interest rate for NABARD loans is lower than that offered by commercial banks and other financial institutions.

Q6: What is the repayment period for NABARD loans?

Ans: The repayment period for NABARD loans varies depending on the type of loan and the purpose for which it is taken. Typically, the repayment period for long-term loans can be up to 20 years, while short-term loans are usually repaid within a year.

Q7: Does NABARD offer any subsidy or grant for rural development?

Ans: Yes, NABARD offers various subsidy and grant schemes to support rural development initiatives, including subsidies for solar pumps, micro-irrigation, and other farm equipment, as well as grants for rural infrastructure development, skill development, and capacity building, among others.

Q8: How can I get more information about NABARD and its services?

Ans: You can visit the NABARD website (www.nabard.org) or contact the nearest NABARD branch or regional office for more information about its services, loan products, subsidy schemes, and other initiatives for rural development.

Features & Articles

Top 5 Concrete Transit Mixers Price in India – 2026

Explore the Top 5 concrete transit mixers prices in India 2026. Compare Tata Motors, Eicher, and BharatBenz concrete mixers with specs, features, and prices for construct...

09-Feb-26 10:02 AM

Read Full NewsTata Trucks Price & Best Models 2026

Explore Tata Trucks Price India 2026 with detailed specs, payload, mileage, and features. Compare top Tata truck models, latest launches, and best options for business an...

03-Feb-26 01:08 PM

Read Full NewsTop 5 Electric Buses Leading India’s Green Revolution in 2026

Explore top electric buses in India 2026 with prices, range, features, and comparison of Switch, Tata, EKA, Olectra, and SML electric buses....

30-Jan-26 10:47 AM

Read Full NewsICV vs HCV Trucks: Which Is More Profitable in 2026?

ICV vs HCV trucks in 2026 explained with costs, mileage, ROI, maintenance, and profitability. A simple guide for Indian fleet owners to choose the most profitable truck t...

27-Jan-26 11:52 AM

Read Full NewsTop 10 Electric Trucks in India 2026: Price, Range, & Payload

Explore the top 10 electric trucks in India 2026 with prices, range, payload, and features....

22-Jan-26 09:17 AM

Read Full NewsDiesel vs CNG vs Electric Trucks in India 2026: Choosing the Right Truck for Your Business Needs

Compare diesel, CNG, and electric trucks in India. Understand costs, performance, and business suitability to choose the right truck for long-haul, city logistics, or eco...

21-Jan-26 11:12 AM

Read Full NewsAd

Ad